Term life insurance is only in effect for a set timeframe, but whole life insurance remains in force for the rest of your life (so long as you keep paying your premiums).

That makes it pricier, but a whole life policy can let you leave a financial legacy for your loved ones. It also grows tax-deferred and can build cash value and earn dividends you can use while you’re alive.

Here are our picks for the best companies for whole life insurance. (See our methodology for more on how we made our selections.)

Shop for life insurance

Best whole life insurance companies

Best for couples: MassMutual

MassMutual Life Insurance

-

Cost

The best way to estimate your costs is to request a quote

-

Online quote for term policy

-

Policy highlights

MassMutual has several whole life insurance options, including a survivorship policy, as well as universal and variable life insurance products.

Pros

- Variety of term and permanent policies

- High customer satisfaction rankings

Cons

- Online quotes are not available

- Policies must be purchased through an agent

Who’s this for? MassMutual‘s survivorship policy is a good fit for couples interested in estate planning. Both partners are on the policy, which pays out after the second person dies. The premiums are cheaper than two individual policies but you still retain the cash value component of a whole life policy.

Standout benefits: Whole life policyholders are eligible for dividends, which MassMutual has paid out annually since 1869. In 2025, the company is set to distribute a record $2.5 billion.

Best for dividends: Northwestern Mutual

Northwestern Mutual Life Insurance

-

Cost

The best way to estimate your costs is to request a quote

-

Online quote for term policy

-

Policy highlights

Pros

- Highly rated for customer satisfaction

- Has paid dividends annually since 1872

- Standalone long-term-care policy and rider available

Cons

- Can’t buy policies online

- All policies require a medical exam

- Customer service not available on weekends

Who’s this for? Northwestern Mutual announced a $8.2 billion dividend dispersal for 2025, projected to be the industry’s largest-ever payout. Eligible policyholders can use that money to increase their plan’s value, pay premiums or take as cash.

Standout benefit: Whole life riders include a long-term-care benefit, a waiver of premium and an additional purchase benefit that allows you to buy more coverage at certain ages or life milestones regardless of your health status.

Best for final expense coverage: Ethos

Ethos Life Insurance

-

Cost

The best way to estimate your costs is to request a quote

-

Online quote for term policy

-

Policy highlights

Ethos offers term and permanent policies from top providers like Ameritas, TruStage, Mutual of Omaha, CMFG and Legal & General America. Will and estate planning tools included with most policies.

Pros

- No medical exam

- Guaranteed acceptance option

- Instant coverage

- 100% online application

Cons

- Limited customization

- Whole life policies only available to adults 66 to 85

- Not available in New York

Who’s this for: Available to policyholders between 66 and 85, Ethos‘ whole life plan is a great option for covering the cost of a funeral, legal bills other end-of-life expenses you don’t want to saddle your loved ones with. The $30,000 coverage limit is more generous than many other final expense policies.

Standout benefits: Ethos doesn’t require a medical exam for coverage.

Best for living benefits: Guardian

Guardian Life Insurance

-

Cost

The best way to estimate your costs is to request a quote

-

App available

-

Policy highlights

Guardian offers a variety of policies, including term, whole and universal. Term life insurance can be converted into whole or universal life policies.

Pros

- Has paid dividends since 1868

- Whole life insurance policies up to age 90

- Available in all 50 states

Cons

- Can’t get rate quotes or apply online

- Customer service not available 24/7

- Doesn’t offer auto or home insurance

Who’s this for? While many insurers charge for an accelerated death benefit, it comes standard with Guardian’s whole life policies. If you’re diagnosed with a chronic or terminal illness, you can tap your policy benefits to pay for your care.

Standout benefits: While many insurers cap whole life policies at age 75 or 80, Guardian approves seniors up to age 90.

Best for payment options: State Farm

State Farm Life Insurance

-

Cost

The best way to estimate your costs is to request a quote

-

Online quote for term policy

-

Policy highlights

State Farm offers nearly a dozen term, whole, and universal life insurance products, including survivorship and no-medical exam plans.

Pros

- Reasonable rates

- Top-rated for customer service

- Return of premium benefit available

- Term policies can be converted to permanent

Cons

- Policies must be purchased through a State Farm agent

- Doesn’t sell policies in Rhode Island or Massachusetts

- Fewer riders than the competition

- Accelerated death benefit costs extra

Who’s this for? In addition to a traditional whole life policy with premiums paid until age 100, State Farm has a limited pay policy, which you contribute toward 10, 15 or 20 years. There’s also a single premium whole life that is paid in one lump sum but still has a cash value component.

Standout benefits: Most State Farm term life policies can be converted to whole life, often without a medical exam.

More on our top life insurance companies

MassMutual

Dating to 1851, MassMutual is one of the nation’s largest life insurance companies, with more than $1 trillion in policies in force in 2024. It also offers investment management and retirement planning services.

Policies: Term, whole, universal, variable universal

J.D. Power customer satisfaction ranking: Above average

NAIC complaint index: More complaints than expected

A.M. Best financial strength rating: A++ (Superior)

Northwestern Mutual

The second-largest life insurance company in the U.S., Milwaukee-based Northwestern Mutual wrote more than $13 billion in direct premiums in 2024. It also offers annuities, disability insurance and financial planning services.

Policies: Term, whole, universal, variable universal

J.D. Power customer satisfaction ranking: Above average

NAIC complaint index: Fewer complaints than expected

A.M. Best financial strength rating: A++ (Superior)

Ethos

Specializing in no-medical-exam life insurance, online broker Ethos offers policies underwritten by Ameritas, TruStage, Mutual of Omaha, CMFG and Legal & General America. Coverage is not available in New York.

Policies: Term, whole life

J.D. Power customer satisfaction ranking: Not ranked

NAIC complaint index: Depends on underwriter

A.M. Best financial strength rating: A (Excellent)

Guardian

Guardian has paid dividends to eligible policyholders every year since 1868, with a record $1.6 billion payout for 2025. In addition to term and permanent life insurance, it offers disability insurance and critical illness policies.

Policies: Term, whole, universal, joint

J.D. Power customer satisfaction ranking: Above average

NAIC complaint index: Fewer complaints than expected

A.M. Best financial strength rating: A++ (Superior)

State Farm

State Farm was ranked No. 1 for customer satisfaction in J.D. Power’s 2024 individual life insurance survey. Policies are not available in Massachusetts or Rhode Island.

Policies: Term, whole life, universal, final expense

J.D. Power customer satisfaction ranking: Above average

NAIC complaint index: Fewer complaints than expected

A.M. Best financial strength rating: A++ (Superior)

How does whole life insurance work?

The cash value is only available while the policyholder is alive; however, and your beneficiaries will just receive the stated death benefit.

Whole life policies also often qualify for dividends, or a portion of excess premiums collected that year. They can also be taken as cash, put toward your premiums or used to buy more coverage.

Because whole life insurance is more complicated than term life, you usually have to work with an agent to complete enrollment.

How much does whole life insurance cost?

The cost of whole life insurance varies depending on your age, gender, health status and other factors, as well as the death benefit and payment terms you chose.

According to Policygenius, a $500,000 whole life insurance policy for a healthy 30-year-old male averaged $472 a month in 2024 and about $408 a month for a comparable female.

Rates are higher for older policyholders: a 50-year-old woman would pay about $920 per month for a $500,000 policy and a 50-year-old man would be on the hook for $1,081 a month.

Because the terms are shorter, single premium whole life (SPWL) policies are more expensive: A SPWL plan with $500,000 worth of coverage costs $81,513, according to Policygenius

A final expense policy is a cheaper option: For a policy with a $20,000 death benefit, a 65-year-old man would pay about $110 per month and a 65-year-old woman would pay about $79 per month.

How to shop for whole life insurance

Life insurance is an important but complex part of financial planning. When reviewing providers, there are several things to consider

1. Availability

Not all insurers are licensed nationwide or offer the same products in every state they operate in. Before getting too deep into investigating a candidate, make sure it offers the coverage you want.

2. Coverage limits

When you’re shopping for whole life insurance, consider how much life insurance you need. This is especially true if you’re looking at a final expense policy, which may have a benefit that’s too low to meet your requirements.

3. Riders

Also known as endorsements, riders enable you to customize your coverage. Common ones include:

- Accelerated death benefit rider: You can access benefits early if you’re diagnosed with a chronic or terminal illness.

- Accidental death and dismemberment: Pays a set amount beyond your death benefit if you are killed or gravely injured in an accident.

- Guaranteed insurability: Enables you to buy coverage at certain milestones — after you get married, buy a house of have a child, for example— without a medical exam.

- Children’s term rider: This rider acts like a level-term policy for a dependent child. It’s typically cheaper than a standalone plan and can enable them to buy a permanent life policy when they reach adulthood.

4. Dividends

Many whole life insurance policies are eligible for dividends, which can boost your coverage or subsidize your premiums. Some companies are more consistent with paying dividends than others.

5. Customer service

You’ll need to work with an agent to buy whole life insurance and a policy is essentially a lifelong relationship. So selecting an insurer with good customer service is critical. You can see how companies rank on J.D. Power’s annual individual life insurance survey, review the volume of complaints filed with the National Association of Insurance Commissioners and look at their grades with the Better Business Bureau.

You should also consider whether a provider has a robust website and mobile app that allows you to make policy changes. whether the customer service line has weekend hours and if there are agents in your area.

6. Financial strength

A.M. Best rates insurance companies on their financial strength: A grade of A, A+ or A++ is a good indicator the company will remain solvent and pay out the benefits on your policy when the time comes.

Pros and cons of whole life insurance

Pros

- Premiums remain fixed

- Stays in force your entire life if you keep up with premiums

- The cash value component grows tax-deferred

- Whole life policies can earn dividends

Cons

- More expensive than term life insurance

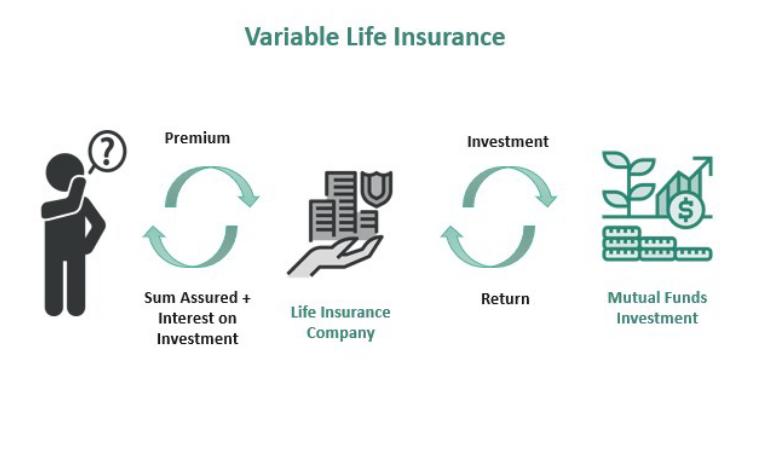

- Unlike a universal life policy, you have no say in how cash value is invested.

- No ability to increase or lower your premium in the future if your income changes

Whole life insurance FAQs

How much is whole life insurance?

Because it stays in force throughout your life, whole life insurance is more expensive than term life. A $500,000 whole life insurance for a healthy 30-year-old male averaged $472 a month in 2024, and about $408 a month for a comparable female.

what is the difference between term and whole life insurance?

When can I access the cash value in a whole life policy?

Your policy needs time to accumulate adequate cash value before you can access funds, usually two to five years after the policy is started. Depending on the amount of your premiums, it can take decades to see meaningful accumulation.

Is whole life insurance worth it?

Whole life insurance is more expensive than term life insurance, so it’s not right for everyone. Depending on your circumstances, though, it can be a great option — especially if you’ve maxed out your retirement accounts and want to save more money tax-free. It can also be the right choice if you’re older and don’t qualify for a term life policy or have dependents who will always depend on you for financial support.

Subscribe to the CNBC Select Newsletter!

Money matters — so make the most of it. Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. Sign up here.

Why trust CNBC Select?

At CNBC Select, our mission is to provide our readers with high-quality service journalism and comprehensive consumer advice so they can make informed decisions with their money. Every life insurance review is based on rigorous reporting by our team of expert writers and editors with extensive knowledge of life insurance products. While CNBC Select earns a commission from affiliate partners on many offers and links, we create all our content without input from our commercial team or any outside third parties, and we pride ourselves on our journalistic standards and ethics.

Our methodology

We incorporated ratings from J.D. Power’s life insurance customer satisfaction survey, the National Association of Insurance Commissioners complaint index and the Better Business Bureau, as well as A.M. Best financial strength scores.

We also considered CNBC Select audience data when available, such as general demographics and engagement with our content and tools.

Our recommendations have been organized by the best for couples, for dividends, for final expense coverage, for living benefits and for diverse payment options.

Catch up on CNBC Select’s in-depth coverage of credit cards, banking and money, and follow us on TikTok, Facebook, Instagram and Twitter to stay up to date.

Editorial Note: Opinions, analyses, reviews or recommendations expressed in this article are those of the Select editorial staff’s alone, and have not been reviewed, approved or otherwise endorsed by any third party.