Affiliate links for the products on this page are from partners that compensate us (see our advertiser disclosure with our list of partners for more details). However, our opinions are our own. See how we rate life insurance products to write unbiased product reviews.

Initially founded in 1859 as Equitable Life Assurance Society of the United States, Equitable Financial Life Insurance Company has over 150 years of experience in life insurance and other investment products. It ultimately rebranded under the sole name of “Equitable” in 2020 and operates under this same name today.

Business Insider compared Equitable Life Insurance to the best life insurance companies and found it to be an average offering, with some interesting offerings held back by its customer service.

Equitable Life Insurance Overview

Equitable Financial Life Insurance Company offers a range of employee benefits, financial advising, and retirement plans. It also offers term, variable universal, and indexed universal life insurance products.

It offers a variety of term life products, from traditional level term to annually renewable life insurance. It also offers convertible no exam life insurance called Term-in-10, named so because applicants can get covered within 10 minutes of applying.

Its variable universal and indexed universal options offer investment options that promote cash value growth, but also has a handful of options for those looking for a more conservative investment strategy.

Because Equitable requires applicants to work with an agent to purchase its policies, it isn’t the best option for people who only want cheap term coverage with online quoting. Equitable term policies also last up to 20 years, whereas some companies offer term life insurance for up to 40 years.

Also, note that Equitable does not offer whole life insurance. So individuals who want this type of coverage will need to look elsewhere.

Lastly, because many of Equitable’s permanent policies require active management and regular interaction with its employees, it’s worth mentioning that Equitable’s customer reviews are less than glowing. It placed 19th out of 21 life insurance companies in JD Power’s customer satisfaction survey.

Equitable Life Insurance Pros and Cons

Equitable Life Insurance Pros

- No exam, convertible term life insurance available

Equitable Life Insurance Cons

- Scored poorly in JD Power customer satisfaction survey

- No online quotes available

- Term life periods only go up to 20 years

Equitable Life Insurance Plans and Coverage

Equitable offers term, variable universal, and indexed universal life insurance, all of which must be purchased through an agent.

Term Life Insurance from Equitable

Term life insurance lasts for a limited time, usually used to cover specific periods in an insured’s life. People often buy insurance to cover their prime working years. Because term life insurance has an expiration date and does not guarantee a death benefit, it’s often the cheapest option that insurance providers offer.

Equitable offers six term life insurance options: three level term policies, two annually renewable policies, and one no exam policy.

Term 10, 15, 20: These three term life insurance policies start at $1 million with level premiums. These policies can be converted to a permanent policy within the first half of the policy’s life.

Annual Renewable Term (ART): The ART policy starts at $1 million. It offers guaranteed renewal for the first three years, and premiums increase annually. This policy is convertible within the first five years it’s in force or before the insured turns 70, whichever comes first.

TermOne: This is an annual, nonrenewable term life insurance policy with death benefits that start at $25,000. This policy is not convertible.

Term-in-10: Equitable’s Term-in-10 earns its name by providing convertible, no exam term life insurance in under 10 minutes. Terms of 10, 15, and 20 years are available with a maximum death benefit of $1 million ($500,000 for those under 21).

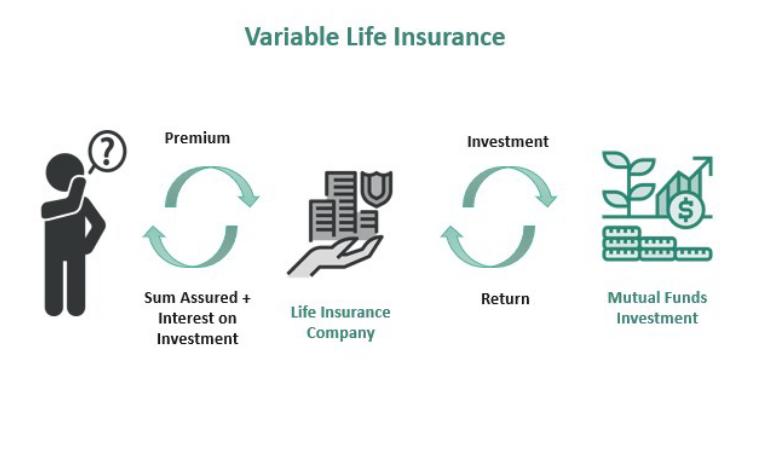

Variable Universal Life Insurance from Equitable

Variable universal life insurance offers a guaranteed death benefit and flexible premiums and death benefits. It also offers tax-deferred cash value growth that grows according to investment decisions made by the policyholder. Policyholders can use this cash value during their life, assisting in large costs like retirement, medical bills, education, or mortgages.

It’s a high-risk policy with high growth potential that requires active management and maintenance from its policyholder. It’s also one of the most expensive policies that insurance providers offer.

Equitable offers two variable universal life insurance options: VUL Optimizer and VUL Incentive Life Protect.

VUL Optimizer: Offers cash value accumulation through “customized, professionally managed investment portfolios” with over 80 investment options across indexes, asset allocations, and equity/fixed income options. It also offers a Market Stabilizer Option II, which is a more conservative option for policyholders nearing retirement.

VUL Incentive Life Protect: Offers over 85 investment options in addition to the market Stabilizer Option II. The Incentive Life Protect also has a No-Lapse rider included, which protects your policy for 20 years or until the policyholder turns 90, whichever happens first.

Indexed Universal Life Insurance from Equitable

Indexed universal life insurance is similar to variable universal life in that part of the premiums are automatically invested. However, this type of life insurance grows cash value according to movements in an index, like the S&P 500.

The primary indexed universal life insurance policy Equitable offers is called BrightLife® Grow. It offers four indexed account options and a guaranteed interest account that sits at 2%. The policy also offers a 0% floor, so your policy is protected against market downturns.

The four indexed account options are as follows:

- S&P 500 Price Return index (one-year segment)

- S&P 500 Price Return index (four-year segment)

- Russell 2000 Price Return index (one-year segment)

- MSCI EAFE Price Return index (one-year segment)

Additional Coverage Options from Equitable

Equitable Financial Life Insurance Company’s term, variable universal, and indexed universal policies have specific presets. For example, some of its permanent policies have no-lapse guarantees that ensure the policy stays in force for a set period of time.

However, it also offers several popular riders to customize policies to fit individual needs. It’s worth noting that buyers cannot customize all Equitable plans with specific riders.

The following insurance riders can customize certain Equitable Financial Life Insurance Company plans based on availability:

- Cash value plus rider: This rider increases the available cash value on some permanent policies by reducing the surrender charge. According to Equitable, the protections could include partial refunds on other policy deductions.

- Charitable legacy rider: This rider lets you provide additional life insurance coverage for up to two qualified charities.

- Children’s term rider: This rider allows the insured to add term life insurance coverage for underage dependents. Dependents can convert their policy to permanent life insurance coverage once they reach adulthood. Minors reaching adulthood can also buy life insurance not connected to the original policy at that time.

- Disability premium waiver rider: This insurance rider provides an automatic waiver of life insurance premiums when the insured becomes fully disabled. Coverage kicks in after the traditional waiting period. Other conditions may apply, and we recommend talking to a licensed agent familiar with Equitable.

- Living benefits rider: This life insurance rider (also called an accelerated death benefit) allows the insured to access all or part of their death benefit if they are diagnosed with a terminal illness and have less than 12 months to live. This money could pay for living expenses, medical bills, and other expenses before the policyholder passes away.

- Long-term care services rider: This rider lets you customize some permanent life insurance options from Equitable with an accelerated death benefit you can use toward long-term care expenses. This would be applicable in the cases of accidents or illnesses that are not necessarily deadly but prevent the policyholder from working, caring for themselves, etc.

- Extended no-lapse guarantee: Some policies come with a no-lapse guarantee, which will last for the first 20 years of the policy or until you turn 90, which ever comes first. An extended no-lapse guarantee can be added when the policy is issued, and ensures that your policy will not lapse throughout your lifetime.

- Return of premium death benefit rider: This rider ensures that the policy’s beneficiaries receive an additional death benefit equal to a set percentage of the premiums paid.

Equitable Life Insurance Cost

Equitable does not offer online life insurance quotes. Quotes for all its policies must be obtained through an Equitable agent.

Many factors control how much you’ll pay for life insurance from Equitable Financial Life Insurance Company, including the type of life insurance you want. Other factors that impact the cost of your policy include:

- Age

- Health

- Death benefit

- Additional riders

That said, Equitable offers some pricing information in its client case study that follows Rashida, a teacher with an annual income of $55,000. Her $500,000, 20-year policy will cost $26.08.

How to File a Claim With Equitable Financial Life Insurance Company

Equitable Financial Life Insurance Company policies are quoted exclusively by licensed life insurance professionals. However, the claims process is largely self-managed. Customers with an Equitable life insurance claim can call the company to file a claim at (800) 777-6510 or online.

Equitable also combines all applicable life insurance claims forms you might need onto one page of its website. Regardless of where you file your Equitable claim, you’ll need to have the following documentation and forms:

- Completed death claim form

(Required for all beneficiaries listed on the policy) - Copy of the original life insurance policy (if available)

- Certified copy of death certificate

- Additional death claim forms that can apply

We also recommend having the policyholder’s name, date of birth, and social security number on hand. Once you have filed a life insurance claim with the company, you’ll need to send the required documentation to one of the addresses below.

Regular Mail

Equitable

PO Box 1047

Charlotte, NC 28201-1047

Express Mail

Equitable

National Operations Center

8501 IBM Drive, Suite 150

Charlotte, NC 28262

Equitable Life Insurance Customer Reviews and Ratings

Equitable life insurance has overwhelmingly negative reviews online, receiving an average of 1.7 stars on Trustpilot and 1.13 stars on its BBB page. Customers mentioned trouble canceling permanent policies and receiving their cash value and issues receiving death benefits months after the insured’s death.

Online reviews of life insurance companies are often overwhelmingly negative, as people who leave reviews often only do so because they have something to say, which is usually negative. It’s also worth mentioning that these reviews pertain to Equitable as a whole, not just its life insurance services.

The National Association of Insurance Commissioners’ complaint index rates insurance companies based on how many complaints they receive against its share of the market. A 1.00 means that a company has an expected number of complaints based on its size. A lower score indicates fewer complaints than expected and a higher number indicates more complaints than expected. Equitable scored a 0.19, indicating that it has far fewer complaints than expected.

However, it scored exceptionally low in JD Power’s 2024 life insurance customer satisfaction survey. Of the 21 insurance companies surveyed, Equitable placed 19th, receiving 594/1,000 while the survey average was 648/1,000. For reference, State Farm placed first at 699/1,000.

Equitable received an A (Excellent) financial stability rating from AM Best, meaning that it is likely to pay out death benefits.

Equitable Life Insurance Alternatives

Equitable Life Insurance vs. Gerber Life Insurance

Gerber Gerber Life Insurance is another company to consider if you’re looking for policies for all ages. Gerber’s main claim to fame is that it doubles the value of life insurance policies on minors once they reach age 18. However, death benefits for children are relatively low.

Gerber offers term life insurance coverage, whole life insurance, and an adult accident-based policy. Seniors may also be eligible for guaranteed coverage with no medical exams on funeral cost life insurance. Gerber’s life insurance plans list is more diverse than Equitable’s, and it offers plans geared explicitly towards parents buying plans that will follow children into adulthood.

But both companies seem to apply similar death benefit limits. Neither company provides strong life insurance plans if you’re looking for higher limits or financial planning options.

Read our Gerber life insurance review.

Equitable Life Insurance vs. Protective Life Insurance

PLICO Protective Life is another life insurance provider operating for over 100 years. This company also offers a range of life insurance policies, including term life insurance, indexed universal life insurance, variable universal life insurance, and whole life insurance. Both companies also offer comparable insurance riders to customize and enhance coverage.

Protective Life makes it possible to get life insurance quotes for its term policies online and has terms that go up to 40 years. However, it lacks no exam policy options.

Protective Life’s indexed universal life insurance is less flexible than Equitable’s, only tracking the S&P 500 compared to the four index options that Equitable offers.

Protective Life is also better rated when it comes to customer service, placing 9th out of 21 life insurance companies in JD Power’s 2024 customer satisfaction survey while Equitable placed 19th.

Read our Protective Life insurance review.

Equitable Life Insurance FAQ

Yes, Equitable offers no exam term life insurance called Term-in-10, which offers up to $1 million in convertible term life insurance with no exam necessary. Policies can be issued within 10 minutes, hence the name.

No, Equitable life insurance quotes must be obtained through an agent.

No, Equitable life insurance does not sell whole life insurance.

Equitable life insurance is a trustworthy company with an A rating for financial strength from AM Best, an A1 rating from Moody’s, and an A+ rating from Standard & Poor’s.

Why You Should Trust Us: How We Reviewed Equitable Life Insurance

The four primary criteria Business Insider uses to review life insurance providers are affordability, customer service, reliability, and company offerings.

Companies receive five stars for cost when premiums are close to the industry average cost of life insurance. According to our article on the average cost of life insurance, a life insurance policy may run you about $40 to $55 a month. However, cheap life insurance doesn’t mean you’re getting quality coverage. So, we weigh affordability against the company’s offerings, customer service, and other factors.

We used the latest JD Power life insurance study to determine which company offers quality customer service. Approximately 3,000 life insurance customers score insurance companies yearly based on communication, interaction, price, product offerings, and statement satisfaction. Companies ranking above the industry average of 774 points have strong customer service.

We also used AM Best, a renowned credit rating agency, and the NAIC’s complaint index to evaluate a company’s financial stability and trustworthiness. AM Best tells us a company’s financial health, and the NAIC’s complaint index scores a company based on the aggregate total of complaints it receives.

Finally, we looked at what each company has to offer, including policy options, riders, and features like medical exam waivers. We also determined which demographic would most benefit from the company based on its products and prices.

Read more about how Business Insider rates life insurance.